AWA: Academic Writing at Auckland

Title: Current economic recession

|

Copyright: Junia Ooi

|

Description: Causes and possible solutions for the current economic recession.

Warning: This paper cannot be copied and used in your own assignment; this is plagiarism. Copied sections will be identified by Turnitin and penalties will apply. Please refer to the University's Academic Integrity resource and policies on Academic Integrity and Copyright.

|

Writing features

|

Current economic recession

|

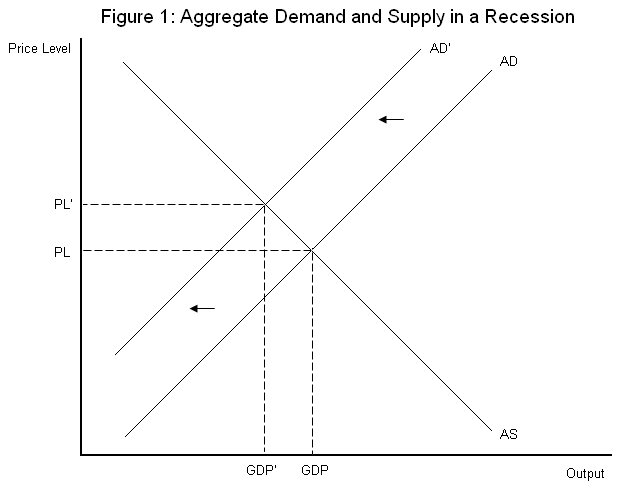

The current economic recession has been referred to as the most severe global recession since World War II (Helbing, 2009). The United States (US) was the first to announce a recession in late 2007; now four out of five of the world’s largest economies have experienced recessions. To properly understand the current economic state, one must understand the causes of the recession; beginning with the subprime mortgage crisis in the US which caused low business and consumer confidence and resulted in banks being reluctant to lend. When compared to the Great Depression the current economic recession doesn’t seem too bad, however, with poverty rates in the US being the highest in 12 years (Eckholm, 2009) it is clear that something must be done to combat the rising level of unemployment. The American government has intervened by introducing expansionary fiscal policies designed to boost growth by increasing government spending. Early on in the Great Depression government policies kept intervention minimal, but the economy was cured when World War II forced the government to increase government spending exponentially. I believe that history sets a precedent that government spending is necessary for a country trying to escape recession; therefore I support Paul Krugman in his belief that it is necessary for governments to run budget deficits (Madrak, 2009). The question of who to blame for the economic recession is much debated, but it has been widely established that the fundamental cause of the recession was the US subprime mortgage crisis. In 1994, the US government changed the Community Reinvestment Act of 1997; these changes ensured banks served “low and moderate income geographies” and “empowered persons of low and moderate income” (Ludwig, 1993). In simple terms the changes made it easier for low income groups or those with poor credit ratings to obtain mortgages known as subprime mortgages. These mortgages were sold to investment firms who were to receive income from mortgage payments, who in turn sold shares of that income to investors (Stock Market Investors, 2009). Low interest rates in the early 2000s caused subprime mortgage activity to grow “an average 25% a year from 1994 to 2003”(Kirchoff & Block, 2004) with most mortgage holders opting for Adjustable Rate Mortgages (ARMs). This meant that in 2006 when interest rates rose and house prices fell, homeowners with little paid on their mortgages realised that selling their house would lose them money as market value of their home would be less than their mortgage (Amadeo, 2009). This rationalisation caused the rate of mortgage defaults to increase severely, which meant a rising number houses were for sale, causing house prices to plummet further (Helbing, 2009). Banks became reluctant to lend money, not only to the public but to companies and other financial institutes, pushing the lending rate higher. The collapse of Lehman Brothers (and other such financial banks) shocked the world; causing consumer and business confidence to plummet, this combined with the inability to borrow money meant businesses started to decrease investment and consumers decreased consumption. A decrease in consumption and a decrease in investments results in an overall decrease in aggregate demand, causing an increase in the price level and a decrease in Gross Domestic Product (GDP), known as a recession (see figure 1).

Editor's note: AS and AD labels should be opposite. The severity and swiftness with which the recession overwhlemed the globe is largely attributed to panic by consumers and businesses (Ivry, Pittman & Harper). Luckily however, despite being labelled the worst recession since WWII (Helbing, 2009), the current recession has not deteriorated to the point of the Great Depression. The present recession has seen unemployment in the US grow to an average of 9% in 2009. This rise in unemployment, though seemingly high, is small compared to the rise during the Great Depression in which unemployment rose from 3% to 25% in four years (Mankiw, 2008). Likewise, the decrease in GDP currently can be compared to the decrease in GDP during the Great Depression. GDP in the US decreased 6.2% in the fourth quarter of 2008 (Bureau of Economic Analysis, 2009) a relatively high rate to that of the third quarter of 2008 in which GDP decrease by a mere 0.5% (Bureau of Economic Analysis, 2009). The decrease may seem high until you compare it with GDP falling by 50% between 1929 and 1933 (Bloom, 2008). An alarming similarity that exists between the two recessions is that “stock market volatity in recent days has reached levels not seen since the 1930s” (Mankiw, 2008); a problem because stock market volatility leads to a loss in consumer confidence. Economist Gregory Mankiw wrote that the Great Depression was largely due to low confidence levels and low liquidity, while the current problem is one of solvency “which is harder to solve” (2008). While there are similarities between the Great Depression and the current global recession, let us be grateful that the shock of the current recession is not as great as the Depression. In an effort to combat a failing economy the US government has implemented several policies to try and increase GDP and pull the country out of recession; the two main policies being The Recovery Act implemented in early 2009 and the Economic Stabilization Act of 2008. The Economic Stabilization Act of 2008 is a law which “gives the United States Secretary of Treasury up to $700 billion USD with which it can purchase assets and mortgage back securites”(US financial bailout plan, 2009) in the hopes of restoring liquidity to failing entities. The ‘bailout plan’ was also designed to boost confidence in the stability and security of financial institues. The Recovery Act was created in February 2009, designed to inject money into the economy and save jobs. The Recovery Act encompasses $787 billion government spending being allocated to twenty-eight various government agencies (FAQs for Citizens, 2009). The Act has several long term goals which involve computerizing health records, renewable energy, increasing college affordability and cutting taxes (FAQs for Citizens, 2009). Both of these policies are considered to be expansionary fiscal policies; they involve an increase in government spending. The increase in government spending is hoped to cause an increase in aggregate demand, which wil result in an increase in GDP (ie. growth) and pull the economy out of recession. The increased government spending has put the US economy in deficit, meaning that it is spending more that it earns in tax revenue; the ten year deficit estimate being roughly $9 trillion dollars (Garrett, 2009). Such large deficits have led some to quesiton the sensibility of this course of action; it has been argued that current deficits will mean an increase in future interest rates, hurt US workers and their living standards (Federal deficit 9 trillion and counting, 2009). In contrast to the policies being implemented now, politicians during the Great Depression were reluctant to increase government spending. To begin with, President Herbert Hoover was in presidency; he did not believe that the government should intervene in the economy (The Great Depression and New Deal, 2009). It was his opinion that without intervention the economy would restore itself; he argued that government assitance would “weaken the moral fibre of the American people” (The Great Depression and New Deal, 2009). These policies led to the election of President Franklin D. Roosevelt in 1932 (The Great Depression and New Deal, 2009). As president, Roosevelt passed the National Industrial Recovery Act (NIRA) of 1933 which established the strategy of centralized planning as a tool (The Eleanor Roosevelt Papers, 2003). Firms were discouraged from lowering prices below cost, to try and stabilize unemployment (The Eleanor Roosevelt Papers, 2003). Under the NIRA the Public Works Association was established to fund unemployment schemes; which were ineffective as the number jobs created was far less than the number of unemployed (The Eleanor Roosevelt Papers, 2003). Despite many government policies attempting to cure the Depression, the eventual end of the Depression was brought about by World War II. War increased government spending to such a level that the US economy was restored to pre-Depression employment and prosperity (The Great Depression and New Deal, 2009). The current expansionary fiscal policy being implemented by the United States will increase aggregate demand as government spending increases thus increasing GDP and pulling the country out of recession. Such government spending will also create jobs, decreasing unemployment level and raising consumer confidence. Therefore I believe that these actions are necessary to restore the economy. However the government must be wary of how much debt the get in to, and ensure that they do not increase debts so much as to burden future generations. In the 1930s the US escaped the Great Depression by increasing government spending due to the war, establishing a precedent that recessions can be fought with increased government spending. This leaves me to side with Paul Krugman and his insistence that the government must run a budget deficit in order to help the ailing economy (Madrak, 2009). Undoubtedly, the current economic recession has hit many countries hard, causing a flurry of hasty government policies put in place to try and stop things deteriorating further. However there has been doubt as to what is the right policy for governments to implement. I support Paul Krugman in his reiterated belief that for a country to recover from recession it’s government must run a budget deficit (Madrak, 2009). For a government to pull a country out of recession they must inject more money into the economy than they take out, in other words, run a deficit. Government spending ended the Great Depression, so it stands to reason that government spending could end the current recession. In America, poor government policies allowing lower income groups to obtain mortgages was the fundamental cause of the current recession; hopefully the government will rectify its errors and implement expansionary policies to pull not only America, but the world, out of recession.

Word Count: 1641

Reference List Amadeo, K. (2009). Causes of Economic Recession. Retrieved October 1, 2009, from http://useconomy.about.com/od/grossdomesticproduct/a/cause_recession.htm Bloom, N. (2008). The credit crunch may cause another great depression. Retrieved October 1, 2009, from http://www.voxeu.org/index.php?q=node/2243 Bureau of Economic Analysis. (2009). GROSS DOMESTIC PRODUCT: FOURTH QUARTER. Retrieved October 1, 2009, from http://www.bea.gov/newsreleases/national/gdp/2009/gdp408p.htm Eckholm, E. (2009). Last Year’s Poverty Rate Was Highest in 12 Years. Retrieved October 1, 2009, from http://www.nytimes.com/2009/09/11/us/11poverty.html FAQs for Citizens. (2009). Retrieved October 1, 2009, from http://www.recovery.gov/FAQ/Pages/ForCitizens.aspx Federal deficit 9 trillion and counting. (2009) Retrieved October 1, 2009, from http://recession.org/news/federal-deficit-nine-trillion Garrett, M. (2009). Obama Administration to Increase 10-Year Deficit Estimate to $9 Trillion. Retrieved October 1, 2009, from http://www.foxnews.com/politics/2009/08/21/official-obama-increase-year-deficit-trillion/ Helbing,T. (2009). How similar is the current crisis to the Great Depression? Retrieved October 1, 2009, from http://www.voxeu.org/index.php?q=node/3514 Ivry, B., Pittman, M., & Harper, C. (2009). Failed mission to rescue bank giant. Retrieved October 1, 2009, from http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10596794&pnum=0 Kirchhoff, S. & Block, S. (2004). Subprime loan market grows despite troubles. Retrieved October 1, 2009, from http://www.usatoday.com/money/perfi/housing/2004-12-07-subprime-day-2-usat_x.htm Ludwig, E. (1993). Press Briefing. Washington: Office of the Press Secretary. Madrak, S. (2009). Krugman: The Deficits Saved The World. But Then, It's Only A Problem When Democrats Do The Spending. Retrieved October 1, 2009, from http://crooksandliars.com/susie-madrak/krugman-deficits-saved-world-then-its Mankiw, G. (2008). But have we learned enough?. Retrieved October 1, 2009, from http://www.nytimes.com/2008/10/26/business/26view.html Stock Market Investors. (2009). The Subprime Mortgage Crisis Explained. Retrieved October 1, 2009, from http://www.stock-market-investors.com/stock-investment-risk/the-subprime-mortgage-crisis-explained.html The Eleanor Roosevelt Papers. (2003). Public Works Administration. Retrieved October 1, 2009, from http://www.nps.gov/archive/elro/glossary/pwa.htm The Great Depression and New Deal. (2009). Retrieved October 1, 2009, from http://iws.ccccd.edu/kwilkison/Online1302home/20th%20Century/DepressionNewDeal.html US financial bailout plan. (2009). Retrieved October 1, 2009, from http://recession.org/library/financial-bailout-plan |

|