AWA: Academic Writing at Auckland

Title: Economic impact of the Christchurch earthquake

|

Copyright: Vinisha Prakash Kaba

|

Description: This essay examines the impact of the Christchurch earthquake on New Zealand's macro economy.

Warning: This paper cannot be copied and used in your own assignment; this is plagiarism. Copied sections will be identified by Turnitin and penalties will apply. Please refer to the University's Academic Integrity resource and policies on Academic Integrity and Copyright.

|

Writing features

|

Economic impact of the Christchurch earthquake

|

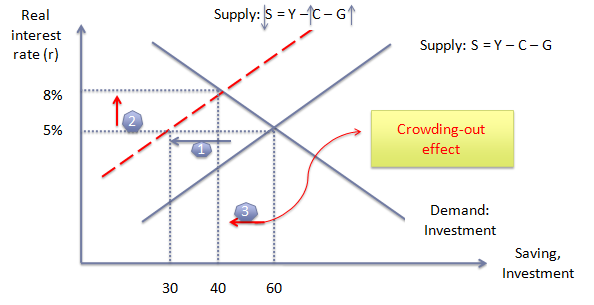

Just when New Zealand was starting to see some hope in its economic recovery, the destructive earthquake struck Christchurch and caused a further disruption to the economy. This essay examines the impact of the Christchurch earthquake on New Zealand’s macro economy. It focuses on the gross domestic product (GDP) and economic wellbeing, cost of living, interest rates, productivity and the unemployment rates of specific groups of people. The relationships between these factors show the effect of the changes in the standard of living of people in New Zealand. It also shows the effects of the earthquake on the factors of productivity which has lead to the slow economic growth. Gross domestic product (GDP) measures an economy’s total income and total expenditure on the output of goods and services. Proved by the circular-flow diagram, an economy’s income must be equal to its expenditure. The four components that make up GDP comprises of consumption, investment, government purchases and net exports (Mankiw, Badyopadhyay and Wooding, 2009). The overall cost of living is determined by consumer price index (CPI) which is a statistic that converts money into purchasing power of people in an economy (Mankiw, Badyopadhyay and Wooding, 2009). The CPI figure is calculated based on a survey of fixed basket of goods and services that represents the typical New Zealand household spending patterns (Rennie, 2007). Increase in CPI results in an increase in spending in order to maintain the same standard of living. The earthquake is likely to cause prices of commodities to go up. In particular, food and housing prices would increase as result of damages. The prices of rental properties, both commercial and residentially, would rise as more people will move out of Christchurch (Reserve Bank of New Zealand, 2011). These are large components of the bundle of goods hence increases the CPI figure, reducing purchasing power of individuals. However, like the GDP figure, there are pitfalls of the CPI figure. The basket of goods included in the CPI figure are fixed thus they are not representative of everybody in the economy. Rational consumers are likely to substitute away from the rise in prices of goods and services. For example, students would move away from Christchurch as education might become expensive or families would move to North Island as rents and housing prices would increase in South Island due to people moving out near Christchurch. People may also create different types of living such as barter system. Households may exchange goods and services amongst themselves. Such exchanges would not be captured by CPI. The CPI would measure a bigger cost of living than actually experienced by consumers (overstated). Individuals that give up on consumption and put away their disposable income are referred to as savers. On the other hand, investors/borrowers are individuals who are willing to consume more than they earn (Mankiw, Badyopadhyay and Wooding, 2009). When financial markets bring the supply (savings) and demand (investment) for loanable funds in balance, they help to allocate the economy’s scarce resources to their most efficient use. Savings is determined by interest rates, disposable income and household levels and investment is based on business confidence, the economic activities and interest rates (Rennie, 2007). Interest rates are a common factor in both saving and investments, it’s the key to economic growth and is determined by the financial system itself. High interest rates encourage people to save, especially after the earthquake as people would become more cautious of their spending (Reserve Bank of New Zealand, 2011). However, the high interest rates make investors and firms reluctant to borrow and make investments which in turn have harmful effects on the growth of the economy. Thus, Bollard decreased the official cash rate (OCR) in order to balance the negative effects of the earthquake. But, in the long-run, the interest rate is likely to increase rapidly as the rebuild of Christchurch and the Rugby World Cup will help the economy begin recovery (Reserve Bank of New Zealand, 2011). This will be due to the increased demand for loanable funds, by both private individuals and government, and insufficient supply (savings). New Zealand was already expecting an $11billion budget deficit which has now increased to $16billion after the second earthquake. A government runs budget deficits when their spending is greater than the tax revenue. The amount of loanable funds available for households and firms decreases as the government will borrow money in order to cover for deficits. The private borrowers, who are trying to find funds to finance their investments, are pushed out (crowding out). This causes the supply curve to shift left due to negative public savings. As a result the interest rate goes up and people demanding for loanable funds (investors) move upward along the demand curve, decreasing demand of loanable funds (Graph). When government reduces national savings, rate of interest rises and investment falls. Investment is important for economic growth in the long-run. Thus, budget deficits reduce the economy’s future growth.

(Mankiw, Badyopadhyay and Wooding, 2009)

The productivity of workers determines a nation’s standard of living. Skilled workers productivity is always higher than unskilled workers. Physical capital, human capital and natural resources are the factors of productivity. In order to increase the real GDP there must be an increase in either input (labour force) or the productivity of the labour force. Productivity is the additional goods and services produced by a worker. GDP cannot increase by spending more as consumers can only spend what is available in the circular-flow diagram (Mankiw, Bandyopaghyay, & Wooding, 2009). Physical capital increases when firms invest in capitals such as machines and durable goods which help workers to produce more, increasing output levels. If the government raises human capital by providing more employment (education/health services) they will become more productive. The same worker is able to produce greater amounts of GDP due to the increased human and physical capital. However, events like the earthquake can destroy natural resources. Cracks left on the grounds cannot be used until fixed. This would decrease productivity and in turn slow down economic growth. Clearly, if government spending is not matched by the actual increase in production, nominal GDP will increase in contrast to real GDP as output levels are not rising (inflation). The amount of unemployment experienced by an economy is another determinant of a country’s standard of living. The unemployment rate is the amount of people in an economy that are willing to contribute to the economy’s production but are unable to find a job (Mankiw, Bandyopaghyay, & Wooding, 2009). The earthquake would have affected the unemployment rate as many people would lose jobs due to their work places being destroyed (MSN NZ Money Staff, 2011). In the short-run the demand for labour will decrease whereas the supply of labour will increase as people are in the work force. This would cause the equilibrium wage rate to be much lower and New Zealand’s minimum wage law would lead to an even higher unemployment rate. However, in the long-run workers in the labour force will experience loss of confidence and the hiring intensions of firms would fall (Eaqub, 2011). As a result the job finding rate will decrease and the job separation rate will increase leading to unemployment benefits. There will also be sectoral shifts in Christchurch’s labour market as the construction industry will demand bigger labour force whereas earthquake affected firms will cut back on employees. Unemployment will mostly affect certain ethnic groups such as the Europeans as they have been settled in Christchurch for a long period of time. They’re not mobile like the immigrants and therefore are unlikely to move. Pacific islanders are said to have the highest unemployment rates. However, the construction industry will demand well-built and strong males hence the unemployment rate of pacific islanders may decrease. Elders are unlikely to be affected by unemployment as they have life-long savings and pensions. Whereas, the youth are on their own thus would struggle to pay expenses without a job. Finally, female unemployment rate will increase as construction industries will demand males rather than females. To conclude, the short term effects of the Christchurch earthquake are; fall in GDP due to the weak consumer demand and business confidence, increased CPI, high unemployment rates which lead to lower productivity, meaning drop in economic growth. However, in the long run the increase in GDP due to reconstruction of Christchurch will result in a slow economic growth. But, the government will continue to run persistent budget deficits which will crowd out private investors, reducing the economy’s future growth. Word Count: 1,669 (including citations)

Works Cited Eaqub, S. (2011, April 6). Flat economy putting the sqeeze on. (N. Chalner-Ross, Interviewer) Fallow, B. (2011). Fall in GDP expected after economy skirts recession. NZ Herald . Retrived April 3rd, 2011, from Mankiw, G. N., Bandyopaghyay, D., & Wooding, P. (2009). Principles of Macro Economics in New Zealand. Cengage Learning Pty Limited. Rennie, D. (2007). Understanding Economic Issues, NCEA Level 2. Representatives, H. o. (17 March 2011). Earthquake, Christchurch—Effect on Government Finances. New Zealand Parliament. Retrived April 3rd, 2011, from Staff, M. N. (8 March 2011). Unemployment set to rise following earthquake. Business News . Retrived April 4, 2011, from New Zealand, R. B. (2011). Monetary Policy Statement.Retrived April 3rd, 2011, from http://www.rbnz.govt.nz/monpol/statements/mar11.pdf

|

|